JobTrainer explained: What is it, who qualifies, what does it pay?

The Australian government has announced a A$2 billion skills package it has dubbed JobTrainer.

It follows JobKeeper, the wage subsidy program (worth about A$70 billion); Jobseeker, which doubled the A$550-a-week unemployment benefit (as well as other government income payments, at a cost of A$14 billion); and JobMaker, providing A$250 million to stimulate work in the entertainment, arts and screen sectors.The JobTrainer package has two parts.

The first part, worth A$1.5 billion, is aimed at keeping those already in apprenticeships and traineeships employed.

The second part is aimed at school leavers and those looking for work. It provides A$500 million for vocational education and training courses. That funding is conditional on matching funds from state and territory governments.

Subsidising wages

The A$1.5 billion to subsidise the wages of currently employed apprentices and trainees extends a pre-existing program called Supporting Apprentices and Trainees.

It covers half the wage eligible employers pay apprentices and trainees, up to A$7,000 a quarter (A$28,000 a year). This compares to A$9,750 the Jobkeeper pays as a flat rate of A$750 a week.

But unlike JobKeeper, employers are not required to demonstrate reduced turnover to qualify.

There is a cut-off criteria according to organisation size, but it’s more generous than the scheme it extends. Previously the subsidy was only available to businesses with fewer than 20 employees. Now the limit is 200.

The federal government estimates about 90,000 businesses will use the scheme, supporting about 180,000 apprentices or trainees. The scheme is scheduled to run till March 31 2021.

Differences between subsidies & eligibility requirements for JobKeeper & JobTainer

| JobKeeper | JobTrainer - Supporting Apprentices and Trainees wage subsidy | |

| Wage subsidy | A$1,500 per eligible employee per fortnight, A$9,750 a quarter (A$39,000 per year) | 50% wage subsidy, up to A$7,000 a quarter (A$28,000 per year) |

| Employer eligibility | Must meet a 'fall in turnover' test and be an 'eligible' entity | Is not required to demonstrate a 'fall in turnover' but must have fewer than 200 employees or be re-engaging an apprentice or trainee displaced from an eligible small or medium sized business |

| Employee eligibility | On March 1 2020 were a full time, part time or fixed term employee, or a long-term (over 12 months) casual employee | Must be an apprentice or trainee employed on July 1 2020 |

Vocational education & training

The second part of the JobTrainer announcement is expected to support an extra 340,000 free or low-cost course places from September 2020 – dependent on the states and territories matching the federal goverment’s A$500 million.

Funding will prioritise courses in areas the National Skills Commission has identified to as likely to see job growth. Examples nominated include health care and social assistance, transport, warehousing, manufacturing, retail and wholesale trade.

Many of the 340,000 training places are likely to be shorter courses, known as skills sets, which are parts of full qualifications.

These skills sets can provide students entry into new industries and also pathways to full qualifications which Australians can access through existing funding and subsidy arrangements.

Public, not-for-profit and private training organisations will all be eligible to apply for funding to provide these courses.

The vocational education and training system has suffered many problems over the past decade – including policies that resulted in widespread rorts and funding cuts.

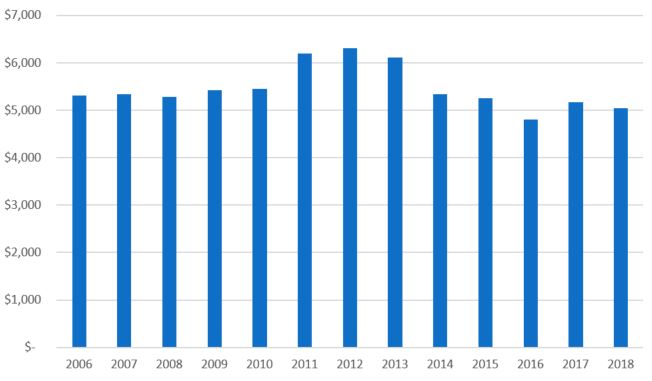

Even with an extra $1 billion in funding, total government support is still likely to be lower than its 2012 peak.

Government funding of vocational education & training courses ($ million)

Graph - text alternative

Graph showing total government funding of VET courses from 2006 to 2018, peaking between 2012 at just above $6.3 billion and declining to just above $5 billion in 2018.

What’s missing from JobTrainer

JobTrainer doesn’t provide any new incentives or subsidies to encourage employers to take on new apprentices or trainees.

In April and May 2020 the number of new apprentices and trainees fell 33% (PDF) on the same months in 2019.

The Mitchell Institute has previously highlighted how fewer apprenticeships and traineeships can have negative long term effects.

This is especially true for school leavers. About 12% of all school leavers take an apprenticeship or traineeship as a pathway into the workforce.

Not making a successful transition from school to the workforce is associated with poor long-term outcomes. These include higher rates of long term unemployment, high incidences of health problems and a lifetime engagement with the workforce characterised by low pay and precarious work.

Fewer new apprenticeships also disrupts the pipeline of skilled workers. An apprenticeship usually takes four years. This means a reduction in new apprentices now will result in fewer people completing their apprenticeship in four years’ time.

The JobTrainer policy probably won’t be enough to keep all current apprentices and trainees in their jobs. Employers faced with reduced work and uncertain conditions may still make the difficult decision to suspend or cancel a training contract.

But it is certainly welcome assistance to keep those losses to a minimum.![]()

This article is republished from The Conversation under a Creative Commons license. Read the original article.